Although I have restricted this blog site to the discussion of DoD IT acquisition, I feel compelled to open the discussion to current issues that could easily trump DoD or even National Security. At a minimum the current DoD budget environment is a slave to these issues.

For those of you that are following the state of play of the Euro and its relationship to the dollar and other world currencies, I found today’s New York Times article on coordinating central banks very interesting.

This article discusses how central banks are working together to influence global currencies to help ensure international prosperity. If you have followed any of these ideas you know this to be a loaded issue.

According to the book Currency Wars by James Rickards, in 2009 the John Hopkins University’s Applied Physics Lab was host for an economic war game designed to address the relationship between world currencies and National Security. In this book Rickards describes how this war game helped educate senior military leaders to the relationship between our currency and National Security and how this scenario is now playing out.

In this book Rickards describes how this war game helped educate senior military leaders to the relationship between our currency and National Security and how this scenario is now playing out.

“The financial war game was the Pentagon’s first effort to see how an actual financial war might evolve and to see what lessons might be learned.” Rickards, James (2011-11-10). Currency Wars: The Making of the Next Global Crisis (Kindle Locations 158-159). Penguin Group. Kindle Edition.

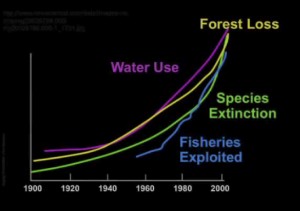

Chris Martenson, http://www.goldmoney.com/

Unfortunately we citizens and our current elected representatives understand little about this economic black magic — implying virtually no chance that they/we will unravel it. Worse yet, we are part of three generations of fellow citizens that believe we should only elect/reelect into office those representatives that promise to provide us more of the prosperity we have enjoyed during the past twenty years. Hence the recent abject failure of the budget super committee!

The coming years will truly be interesting! It is important for us all to become aware of the four E’s in which we are living…

Great post. The comment I’ve seen stand out in the budget debate is that with the current budget/debt profile, the entire tax base is currently going to pay for 3 things: Medicare, Social Security, and interest on the debt. Our government is effectively borrowing every single dollar needed to cover their entire operating budget-mail, roads, schools, defense, etc. So we are obligated by treaty to defend Taiwan against an attack from China, and are effectively borrowing the money needed to do that from China…

Good comment Phil, said another way, China owns approximately one-third of our National debt which is close to exceeding the annual U.S. defense expenditure. China also spends approximately one-third the amount the U.S. does for annual defense expenditure. With a little math one can see that the U.S. is funding the defense build up for China through our National debt.

Marv, thank you for another great post and new book to read. I have added currency wars to my christmas list!

We discussed “Age of Unthinkable” with some similar concepts expressed as those in the video link. The video had me recall the famous quote from the Saudi prince who predicted the age of oil would not end from a shortage of oil “..the stone age did not end from a lack of stone…” Perhaps the age of “cheap energy” we have a different forces at play.